Retail a barometer of the economy. What was the situation of Polish retail in 2022?

! ► Retail is sensitive to changes in the environment, as shown by the Monthly Confidence Index.

! ► Retail companies are cutting operating costs in order to maintain liquidity.

! ► Retail companies have negative employment intentions, with more planning to reduce their workforce rather than increase it.

! ► Investment spending by retail companies has declined, with more companies citing lack of financial capacity as the reason for not investing.

! ► Despite the challenging environment, some retail companies have been able to identify market opportunities and build competitive advantages.

Retail sensitive to change

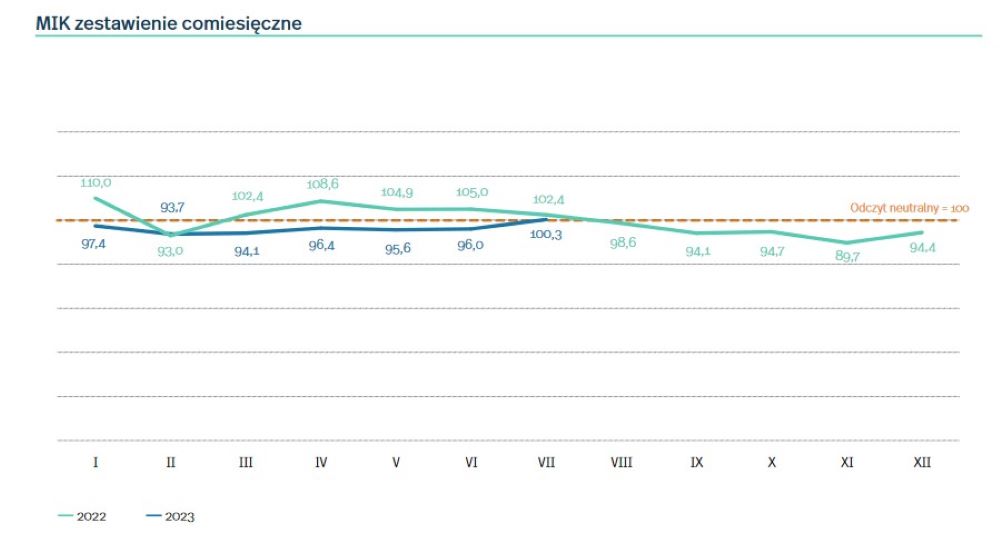

Retail is an economic sector characterized by a relatively high sensitivity of businesses to changes in the environment. This is confirmed by the Monthly Confidence Index, which is a synthetic indicator showing business sentiment. In February, the month of war between Russia and Ukraine started, the MIK for trade fell to 95.5 points, i.e. below the neutral level (100.0), signifying the predominance of negative sentiment of trading companies. As recently as January, the MIK level was 115.1 points. In the next few months (March-June 2022), positive sentiment prevailed among retail companies, thanks in part to consumer increased holiday spending (Easter) and the beginning of the summer season. Unfortunately, already in the second half of the year, the index of business conditions for trade fell below the neutral level, and despite some improvement in the December reading (98.6 points, compared to 91.3 points in November), negative retail sentiment persists.

Retail cuts operating costs

Business sentiment in the retail sector in 2022 was strongly affected by the uncertainty of the economic situation and rising operating costs of the company. In the December, as many as 81 percent of surveyed traders indicated the great or very great importance of uncertainty in the economic situation as a barrier to business operations, up from 72 percent of indications in January. Also as a high or very high barrier to business operations, traders considered energy prices (69 percent of indications). Another burdensome barrier is employee costs (60 percent), mainly due to employee pressure to raise salaries. In view of the weakening sales dynamics of products and services, as a result of consumers cutting back on purchases due to high inflation, the key challenges for trading companies, especially in the second half of 2022, have become the reduction of company operating costs. These measures in many retail companies have proven to be essential for maintaining company liquidity.

Will retail be hiring?

Retail companies' employment intentions are worrisome. In the December survey, only 6 percent of companies planned to increase staffing levels compared to 17 percent saying they would reduce their workforce. Employees have been a protected resource for a trading company, especially in the first half of 2022, when more trading companies planned to increase staffing levels than reduce them.

Investment on hold

The declarations of retail companies regarding investment spending are worrying. While as recently as the beginning of 2022, about 40 percent of surveyed companies indicated they had incurred expenditures in tangible and intangible assets in the last three months, there have been fewer and fewer since September (37 percent in September and only 27 percent in December). On the other hand, the group of companies indicating that they did not invest because their financial capacity did not allow them to do so is growing (11 percent in January, 17 percent in September, 27 percent in December). This is a worrying phenomenon for the future development of commercial enterprises, as the introduction of new technologies into companies and the development of employees' competencies, is now becoming an important condition for their competitiveness.

Some retail companies have seized opportunities

The presented results of the PIE and BGK surveys show the key changes taking place in the retail sector in 2022. However, it is worth noting that the population of trading companies is strongly diversified. In addition to companies in a difficult economic situation, there are retail companies that, even in the current hostile environment, are able to spot market opportunities and effectively build their competitive advantages.

Source: Urszula Klosiewicz-Górecka, Economic Foresight Team at the Polish Economic Institute

<< Handel barometrem gospodarki. Jaka była sytuacja sektora w 2022 r.? >>